In the present world of petroleum industry, to extract and continue the production of petroleum products, to sustain the workforce of the industry, and to comply with the world economics, in other words for the survival of this industry many challenges are observed and encountered.

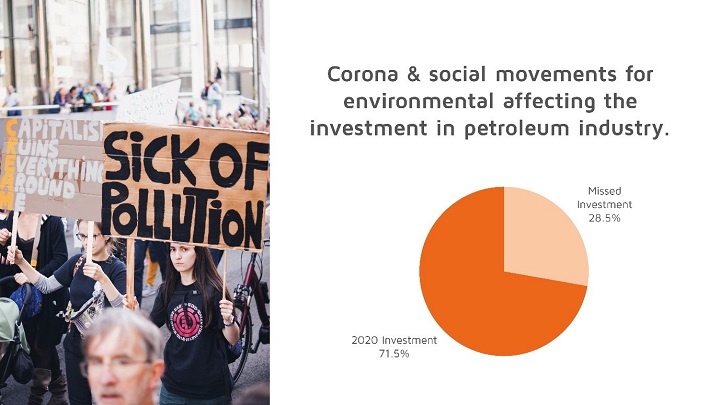

One of the most important challenges is the issue of social movements opposing the policies of banks and financial institutions, to sustain the environment, the ecosystem and the nature. Many social movements and mobilizations are set to protest the carbon emissions and the pollutants resulting from the consumption of fossil fuel energy worldwide, majorly in EU and Japan. Some other countries are still averting the supersedure such as China, India, the USA and Russia.

Some of the major challenges in this industry are stemmed from the environmental arguments surrounding the Paris Agreement by which the governments are bound to lessen carbon emissions rigorously, and to restrict funding fossil fuel consumption and pollution severely.

Besides, there is certainly the issue of the industry’s workforce and laborers of: their psychological problems, required skills, the proper and adequate education and training, all are the challenges in the workforce of petroleum industry, societally and governmentally in some countries. Some of the laborers and the workforce have to stay detached from their families for days and months, working separately on fields and in arenas of extraction-production, such as offshore, frost, etc., living in harsh situations.

There is also the disputes between International and National oil Companies (IOC vs. NOC): The future challenges of national and international companies can be studied from several perspectives. The first challenge is about technology and knowledge, in which international companies are leading the way, and state-owned companies, especially in the Middle East, are following the suit. The second challenge is the ownership of oil reserves, where state-owned companies are better off. International companies have a smaller share of the world’s oil reserves. The third challenge is the pricing of crude oil, in which state-owned companies are considered competitors of international companies.

Although the funding for the fossil fuel industry by the banks and financial market is still extremely abundant (3.5 trillion U.S. $), during the past five years, the Paris Agreement and the U.N. have been struggling worldwide to persuade all to put such consumptions aside and supersede fossil fuels with green clean energy as a proper replacement.

Dependency on petroleum use is another troublesome issue in this argument for many countries, politically and societally. The lands that lack oil and gas reserves must solicit to the lands and the governments that own oil and gas reserves. This has been always a global inclination since petroleum products became available and crucial part of contemporary lifestyle.

Investment in this industry is strategic and requires massive funding from both public and private sectors, internationally and domestically. This industry thusly enmeshes a fabric of multiple interests, attitudes and profits for all involved participants to this industry. That’s why neglecting the petroleum industry even if inclining to reduce the carbon emissions is troublesome and lacks affordability as all nations are enmeshed to petroleum products directly and indirectly.

Changing the lifestyle from fossil fuels to clean green energy is not an easy way to commence. Nuclear energy is not known as a clean energy and not an affordable source, for nuclear energy is severely expensive, dangerous, un-clean, and remains in nature for thousands of years, and does not have a recycle effect, unlike fossil fuels that although they cause short-term pollution, but are easily obliterated by nature itself after some years, if not decades. This is not definitely the case with nuclear disposals, atomic wastes and radiations. Funding fossil fuel sources of energy is still much cheaper than many other energy sources, interestingly. For instance, funding electricity generation plants supplied by fossil fuels is less costly than water energy (hydro-source) in arid and dry lands like Iran, Saudi Arabia, Israel, north of Africa, and some parts of the USA.

Social movements also wrangle about the rights of the laborers and the workforce of this industry. It has been the main topic of argumentation since the first refineries were set and constructed wherein the laborers and experts were working in this industry. Some of the examples of the aforementioned rights include: hygiene for workforce, health effects, food supply, accommodation, salary and wages, distance and geographic location, etc.

Usually the governments are not agile enough to resolve the issues in the fossil fuel industry. Contrarily, the private sector has the proper leverage, cleverness, incentive and fondness to move ahead for novel technologies and advancement in the petroleum industry. This is a major obstacle globally, because if the governments do not advocate innovation in the fossil fuel industry, the refineries won’t work properly, the reduction of pollutants produced as a result of fossil fuel consumption won’t be supervised or regulated, and vehicles consuming fossil fuels won’t be obligatorily standardized in the country and thus their engines won’t be set for a proper range of emissions.

Transference is another trouble in this industry: we want to transfer petroleum products worldwide. This requires supply chain regulations, funding and vehicular advancement, to be accomplished.

Protection against hazards, aside from the pollution it imposes is another trouble in this industry. The gas pipelines are prone to hazards. The petrochemicals being transferred are also a source of hazards. The offshore oil-rig stations might face several hazards like storms, earthquakes, tsunamis, explosions, underground pressure, all affecting the severity of the hazard.

- Some banks, trusts and financial institutions are not interested to invest in fossil fuel industries, commencing 5 years ago. This will cause a decrease in technological advancement and consequently reduction of quality in oil extraction and production.

- The Glasgow conference is an obligatory act that some of the world’s governments must abide by and implement on their lands, to lessen CO2 emission and protect the environment. Hence, these commitments will affect the petroleum industry optimization and improvements. The social and societal movements and revolts such as the green movement of Europe, in recent years, have been exerting moral and legal pressures and constraints on the governments, protesting against the petroleum corporations, to reduce the amount of CO2, lead and other emissions into the atmosphere, while imposing political pressures on the big petroleum corporations as well. As a result, democracy is resisting production of more petroleum and petrochemicals. In other words, democracy and oil production are opposing one another. The feminist, the intellectual and the leftist movements have also allied with the green movement of Iran.

- Corporate social responsibility: This challenge includes relations with various stakeholder groups, health and safety concerns, i.e.human rights, employee rights, stakeholder rights, environmental protection, community relations, transparency and corruption issues. CSR requires oil companies to succeed in each criteria in order to build a reputation as a reliable potential partner for public-private strategic partnerships: cross-sector and governmental.

- NOC vs. IOC: the conflict of interests and strategies amongst the national corporations that belong to governments and international companies. From a variety of views, their disputations and oppositions are posited: the international companies are striving to access the government-owned oil-gas fields, and they want to extract and produce oil and gas and petrochemicals through the cheapest methods and with the quickest efforts. In the meantime, the administrations and the sovereignties are not agile and quick to innovate and obtain novel routes of advancement in technologies and technicality at all. The future of the world will surely observe the conflict amongst these companies, in terms of political wrangles and maybe military interventions.

- Frontier acreage and access to reserves: the frontier acreage challengerepresents exploration and development of new fields that has been previously regarded as too difficult, too expensive or too politically unstable to justify. Also, the remote locations, with newly discovered reserves, like Arctic, far North Sea, pre-salt basins in deep waters of Brazil, and etc. Access to reserves involves competition for access to proven reserves, a subject that became more difficult in comparison to previous decades, due to the expansion of governments’ role.

- Unconventional resources: shale gas, oil sands and coalbed methane (CBM).The problem with these sources of fossil fuels is that they do not belong in the ordinary methods of extracting petroleum from underground (hydraulic fracturing), which is harmful to the nature and raises questions in communities and for the government regarding its potentials as consciousness towards the environment.

- Conventional reserves in challenging areas: they majorly involve two sections for the fossil fuel market. First the politically-unstable countries and governments. Second the areas wherein the law is hindering for petroleum extraction such as Arctic regions or offshore districts near animalia or close to human settlements.

- Rising emerging market demand: Many are investing in the emerging markets for fossil fuel consumption which are mainly China and Asian countries. This has its own risks: as the pricing on fossil fuel in Asian countries is regulated and set by their governments, to invest in such markets does not guarantee free market pricing and earnings for the investors.

- NOC-IOC partnership: the national corporations can partner with the international ones in the petroleum industry. Nonetheless the hazards to this kind of partnership is the settlement of disputations and collaborations will demand rigorous legal basis and trust on both sides. This partnership certainly stabilizes the markets for the fossil fuel production and consumption quickly.

- Innovations and R&D: The more invested in the petroleum industry, the more lucrative the outputs both financially and socially for the markets and for the environment and vice versa.

- Alternative fuels: the biofuels, and fuels that are less harmful to the environment.

- Fiscal policies: taxing on the petroleum sector, impedances from the government on new entrants and users to this market, and increasing pressure on liberty for the participants in this industry, all and all, will hinder the rapid development and use of the petroleum technologies, investments and sharing with others. It will affect prices, demand, supply and distribution of petroleum products, subsequently, both domestically and worldwide.

- Price volatility: the issue of prices in this industry is the main concern in the buyer countries such as China, India, Germany, and Japan that always concentrate on the selling prices from the producing countries like Saudi Arabia and Russia. The less volatile the prices, the more competitive and secure the conditions for buyers, and for sellers as well, mutually.

- Derivations with cost: the more derivatives we produce as the petroleum industry’s outputs, the better the portfolio of sales and purchases we will create. This ensures a range of prices and revenues, and also entails widened interests and demands for the markets.

- Expectancy: we have to ensure that the future of petroleum industry is secured by governments and markets. If there is murkiness in the regulations, the investments or demands, or even the supply side, the petroleum industry will not move ahead properly. Presently, investors want to have expectations for future moves. Thus, the regulators of this industry have to prepare the basis for a proper yield in the future so that all investors, participants and clients will be satiated by predictions and norms being routine, non-volatile and affordably profitable.

- Onboarding and retaining the best talent in the workforce: the industry is facing situations where the most experienced workers are about to retire in the coming months and years after the Corona crisis that hindered the completion of many tasks.

- Operationality: the petroleum industry must operate parallel to the markets, unlike some other industries that are detached partially or wholly from the markets. For instance, if we produce more vehicles in the market, rationally we will demand more fossil fuels from this industry.

- Consumer preferences: what the consumers will demand is a concealed question that many don’t encounter to ask themselves. “will the countries still buy our products later or they will demand different and new products?”. Clients, or buyers and users of the products, usually react to services and products and even to the staff, immediately, with a sense of morality. They prefer to obtain good-valued products and services with proper pricing. They also demand different items of products from the companies to satisfy their demands. Providing better-valued goods and more diversified items and services will incentivise more customers to depend on our company and to be better entangled with our products, services and staff in a friendlier manner. Customers choose to buy what products and from what companies, and they attempt to customize their demands with the price they pay off for the products and the services afterwards.

- Digitalization: this task is nowadays a necessity to make the petroleum industry more agile and quick to operate properly. Many countries such as India, African countries, and OPEC do not yet have this progression for their petroleum market and industry.

- Online marketplace: as all operations are shifted towards the world of internet and online communications, we have to invest much in this sector to boost the communications for the petroleum industry, as fast as possible. In the stock exchange of the countries, buy-and-purchase of petroleum products can be traded easily and reliably. Also, some companies sell-or-purchase their demands and supplies through their own personalized and customized online trading applications, websites or agents through which the customers are interlinked to the company and purchase the products more quickly online.

- Cost reductions: all costs must be lessened as much as possible to yield inexpensive petroleum outputs.

- Job Satisfaction: The personnel, the staff and the participants of the petroleum industry shall obtain a proper level of job satiation, and be delighted with the work itself and the ambit it creates wherein they are spending their life for the company. This will have two endpoints. From one side the company has to satisfy the personnel, from the other side the personnel shall be appeased for what they are operating and whether they have opted for the job with coercion or personal desire and eagerness.

- Planning: if the planning is inadequate for any division of the petroleum industry, the competency of the corporation will diminish gradually due to its poor decisions and operations opposite the new unknown challenges or the predicted challenges that the corporation knew in the past but neglected to act accordingly and postponed the aims.

- Assets and reconstruction-renovation: all assets in the petroleum industry will be aged, deteriorated and must be renewed or renovated and replaced. The cost of maintenance, the period of replacement, and other tasks must be considered for all assets of the petroleum industry, beforehand. Tangible and intangible assets are part of investments in this industry. When a company owns a refinery, this asset shows the government, international investors and others that the company has a financial proper background and can withstand future repercussions in the market. Assets require permanent maintenance, sustenance and monitoring. Even good personnel are clandestine assets of a company. Spare parts, oil-rig, drilling equipment, casing apparatuses and electronic equipment are all examples of assets in petroleum industry.

- Safety: aside from security namely, job security, salary, morales, etc, the petroleum industry must always be secured from any dangers. One mistake will impose costs on the government, the society and the financial markets, apart from the corporation itself. Safety should be observed in engineering, health, usage, extraction, production, as well as other similar categories. Some of the hazard examples include explosions, malfunctioning in the electronics or the chemical processing sectors, improper pieces and non-standardized equipment, sometimes negligence by personnel such as when a worker wrongly conducts a process in the refinery, along with any hazard that might be caused as a result of natural phenomenon, like floods. Safety is set on the premise of forecasting hazards and errors in the future. For instance, we predict that if we don’t fortify the pipelines with insulation, during summer the heat from the sunshine will increase the temperatures exteriorly, endangering the whole processing lines consequently. For safety, the whole region wherein the operations are undertaken must be monitored constantly to mitigate risks of widespread hazards, and containment.

- Efficiency and Productivity: with no productivity, the petroleum industry is simply exerting troubles on the society and government. For instance, when a refinery cannot produce an adequate amount of a product, it will impose shortage of that product in the market, consequently increasing its price.

The global oil industry has taken on the challenges mentioned above. Companies and governments do not have the ability to solve them all. It is futile to expect a new order worldwide in organizations such as the International Energy Agency. This seems to be the development of the oil industry with the environment in the next five years. These various challenges are especially evident in the decrease in banks’ support. The world is moving towards clean energy.

References:

https://www.enggpro.com/blogs/top-7-challenges-facing-oil-and-gas-industry/

https://www.technologyhq.org/top-10-challenges-oil-gas-industry/

https://www.forbes.com/sites/uhenergy/2021/03/10/challenges-and-trends-for-the-oil-and-gas-industry/

https://insurica.com/blog/oil-and-gas-challenges-2022/

https://www.corbanone.com/5-unique-hr-challenges-facing-oil-gas-industry/

https://www.slideshare.net/theoacheampong/theo-acheampong-presentation

We Answer Your Questions